“If Taxation is Theft, Who Will Build the Roads?”

“Taxation is theft” is a popular Libertarian meme that is often objected to with the question about who will build roads. It needs to be qualified. Taxation is theft if the money taken from some people is given to other people who did not earn it. Taxation is not theft if the tax is used to pay for a constitutional provision of government.

Prior to the 16th Amendment (1913), there was no income tax. “[T]he federal government managed its few constitutional responsibilities without an income tax, except during the Civil War period. During peacetime, it did so largely — or even entirely — on import taxes called ‘tariffs.’ Congress could afford to run the federal government on tariffs alone because federal responsibilities did not include welfare programs, agricultural subsidies, or social insurance programs like Social Security or Medicare.”

And we can add to these Obamacare, the Department of Education, Planned Parenthood, and a whole list of alphabet soup agencies that have no constitutional validity.

I found the following in a Facebook post:

If you think that taxation is theft, then stay off the roads, stop drinking water from public water works, don’t use a toilet connected to sewage treatment, don’t go out at night where you need to see by streetlight, don’t EVER go to a hospital emergency room, or call a cop for help, or a fire department if your house is burning down, in fact, if you think taxation is theft, get the hell out of Dodge and go live out in the middle of the desert or in a mountain ravine and STFU already.

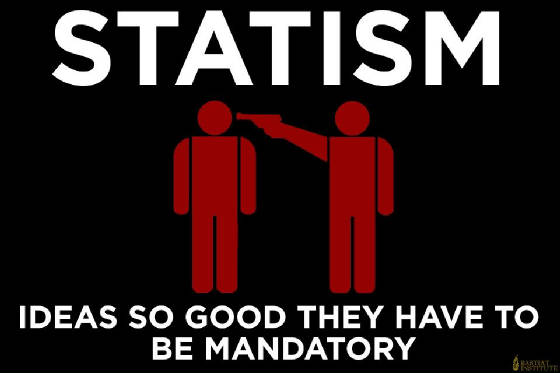

Let’s deal with the “who will build the roads” question. It’s a favorite of Statists. It’s like asking, who will build the cell phone infrastructure or the internet and computer industry?

First, roads are built by private companies.

Second, paying a tax to use roads is not wealth redistribution.

Third, some have proposed privatizing the financing, ownership, and construction of roads. Roads would be built based on demand.

Fourth, turnpikes or toll roads were funded by the people who used them. Toll roads have existed for nearly 3000 years. If you didn’t travel on a toll road, you didn’t pay the fee.

Fifth, the gasoline tax is a non-punitive service tax. The only people who pay the tax are those who use the roads. If you don’t drive, you don’t pay the tax. If you take a taxi or Uber or Lyft, you pay it indirectly in the price you pay for the ride because the price you pay includes the costs required to maintain the transportation vehicle.

The same is true when you and I buy something online and it’s delivered to our home or office. The fuel costs that were necessary to bring the item to market and shipped are built into the price.

You’ve seen signs posted on the rear of trucks: “This vehicle paid $3,642 in road taxes last year.” No, it didn’t! You and I paid the taxes because they are tacked onto the commodities the trucks haul.

With the advent of electric cars, the taxing system will most likely change.

Unfortunately, fuel taxes are no longer held in a trust fund and are now being used for wealth redistribution. “In 1990 Congress approved an increase in the gas tax but allotted only half of the new revenue to building projects. The other half was dedicated to deficit reduction – which then, as now, was all the rage. In 1993 Congress approved another gas tax hike and again devoted some of the revenue to deficit reduction…. When Congress severed the link between the gas tax and infrastructure, it broke the tax itself…. ” (Forbes)

What about water and sewer? Paying for these services is not a tax. Paying for water and sewer is no different from buying chicken or steak at the supermarket. You pay for what you use. The more you use, the more you pay. My son has a well. He does not pay for water. We have a septic system. We don’t pay for sewer.

Someone had mentioned garbage pickup. In some states, local governments have a monopoly on the service. It was that way when I was growing up in Pittsburgh. Georgia has a non-government competitive system. There are difference garbage pickup services to choose from.

While the United States Postal Service has a monopoly on mail delivery, it does not have government control over package delivery. Federal Express, United Parcel Service, and other package delivery companies compete for business. No one is forced to subsidize these companies if they lose money like:

The United States Postal Service’s financial troubles have been well publicized in recent years. The worst of it came in 2012, when the USPS lost a whopping $15.9 billion dollars, followed by $4.8 billion and $5.3 billion in 2013 and 2014, respectively…. Robert Shapiro—former Treasury undersecretary and chairman of the economic consultancy Sonecon—points out in a new analysis, American taxpayers subsidize the USPS at a rate that surpasses the costs associated with any Congressional mandate. He estimates that, all told, the subsidies and legal monopolies that Congress bestows upon the post office is worth $18 billion annually. (Fortune)

Police are governmental. They should be paid for with taxes. The same is true of the military. (Wars are the biggest factor in raising taxes, expanding government, ongoing deficit creep, not to mention the loss of life and property.) Fire departments are financed through property taxes, not an income tax. Water, sewer, police, and fire departments are local, not federal.

While not all taxation is theft, certainly a majority of it is.